How is relabeling KTMs going to significantly grow market share for KTM? Good question ... No resident expert here or business person, but I see what you are asking and have no real answer other than name recognition and 3rd world bike sales ... Maybe markete saturation? Why are we sitting on this web site? Only because it is labeled Husqvarna for me.

I'll just add to your question... SP owns what really? Just the Husqvarna brand name and bunch of spare parts for previous models? His bikes will be build by ktm, in ktm factories, by ktm people? This means the new bike has to be a ktm. How is the money gonna flow between his company and the ktm group? Its starting to sound like a pretty cozy deal just a little foggy still ..

....

I answered this question on the Dirt Bike World forums in Australia at the beginning of the year when this deal was first announced.

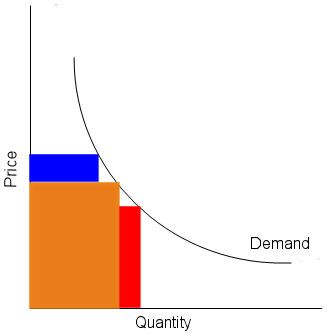

They won't "undercut their own market" - give them some credit. So I am a bit rusty as it's been a while since I did Economics, but I believe this is a classic Market Segmentation ploy to gain extra revenue. The basic theory is that a product (in this case - motorcycles) will sell a set quantity at a set price. As the price rises, less people will be willing/able to buy the product (e.g. Husaberg's), and conversely the lower the price the more more of the product will be sold (hypothetically, Husqvarna). (Plotting the quantity sold against the price the products are sold at will form what is called a "Demand Curve".)

So, at a set price, the company will sell a set quantity of the products - now price x quantity = revenue. Let's just talk revenue for the moment, as profit is a lot more complicated. So in the graph below, KTM earn

revenue represented by the orange box.

Now, the easiest way to increase their revenue is to have another product at a higher price point - and at that higher price point they are going to sell less of them. Lets call the higher priced product "Husaberg". At a certain price point, people will switch from the higher priced good (Husaberg) to the cheaper one (KTM) - this is where people are getting hung up on product "cannibalism" or "undercutting their own market". But the thing is, KTM don't care if you switch from the higher priced product (Husaberg) to the lower priced product (KTM) because they sell both. They make

extra revenue by selling a much lower quantity of the higher priced product - as represented by the blue box in the graph below. So their total revenue is the orange box

plus the blue box

So KTM want to grow their revenue even more now, and they will logically do this by selling a product at a lower price and sell a lot more of them (lets call the cheaper product Husqvarna). At a certain price point the consumer would rather buy a KTM, but the consumer is going to go for the cheaper brand product below that price point, but KTM will sell a lot more of that cheaper product than they would their standard product. So the extra goods they sell at the lower price point is... ADDITIONAL REVENUE, represented by the red box in the graph below. So now their total revenue is the orange box

plus the blue box

plus the red box.

So I think KTM buying Husky as a form of market segmentation in order to grow their revenues is a SMART move. Yes, there will be a level of product "cannibalization" but KTM doesn't really care if you buy a KTM, a Husaberg, or a Husqvarna at a set price point because they get revenue whichever way you cut it.

The trick is that they figure out a way of controlling the

cost of selling those products so that the

revenue growth is turned into

profit growth too. With Husaberg they have done this buy putting KTM engines into the Husaberg bikes - it's been a little bit more than just changing the graphics as the 'Bergs have the 4CS forks etc. The rest of the Husaberg product might be different to the KTM product, but the large cost of the engine (it's R&D, production, spares supply, etc) is shared between the two products

so a larger proportion of the extra revenue earned from that product will be profit than if the product had its own engine supply costs. And I think that's where the big question mark is with this merger/takeover is. It'll be interesting to see how this one pans out.

Here ends todays micro-economics lesson - sorry if I bored you, but if you read it and understood it then maybe you understand the move by KTM a little more (from an Economists perspective anyway). Basically Pierre/KTM are trying to do in the motorcycle world what VW/Audi/Skoda/SEAT have done in the automobile world. A vast majority of the VW Golf, VW Jetta, Audi A3, and the Skoda Octavia are the same, but you would NEVER say they are all "the same car" because there are differences in the physical appearance, internal quality of finish, extra technology included in the base models, etc to differentiate the products.

Personally I hope the Huskies don't lose their advantages over KTM's (like linkage rear suspension for one - controversial opinion, I know), but I think the Husky brand can benefit a lot from KTM technology too.